SOCIETE MINIERE DE NYANGWE S.C.A.R.L.

Constitution

Société Minière de Nyangwe was incorporated on February 16, 1939, with a capital of 1,500,000 francs represented by 3,000 shares of 500 francs, (serie A). The registered office was established in Stanleyville, the administrative headquarters in Brussels.

To the 3,000 Series A shares, were added 3,000 shares without designation of value which will participate in the distribution of the profits under the conditions set forth in Article 34; these securities were given to the Belgian Congo Colony.

In addition, out of the 3,000 shares of 500 (serie A), 1,196 shares were allotted to the Compagnie du Kivu for the contributions made to the new Company.

The remaining 1,804 shares of 500 francs Series A were subscribed for by, see opposite:

The securities were subscribed for cash and fully paid up, the sum of 902,000 was at the disposal of the Company.

Noms La Colonie du Congo belge La Société Minière du Maniéma pour elle et pour un groupe Prosper Lancsweert Alphonse Cayen Jacques Relecom Le comte Maximilien de Renesse Breidbach Nicolas Decker Charles Sampers Lucien Bogaerts Emile Autrique | Actions série A 600 1115 25 25 25 1 1 1 1 10 |

Contribution(s)

The Compagnie du Kivu contributed part of its mining rights to Société Minière de Nyangwe, namely:

- Exclusive research rights within the KabundiLocality in the DRC - Kasenga Territory - Province of Haut-Katanga block, covering an area of 35,402 hectares.

- The right to demarcate in the regions open to its research, in accordance with article 6 of the convention of March 4, 1935, 150,000 hectares, in five blocks, in which the Société Minière de Nyangwe enjoyed an exclusive right of research.

- Right to delimit and exploit 40,000 hectares of mines, both within the above-mentioned blocks and within the Kabundi block, with no mine exceeding 10,000 hectares.

To cover the costs of search and delimitation which amounted to 598,000 francs, the Company received 1,196 Series A shares.

Premier conseil d’administration

Commissaires : Emile Autrique et Lucien Bogaerts.

Object

- Within the limits of the contributions made by the Compagnie du Kivu, the research, study and exploitation of mining deposits and the execution of all exploitation and exploration work under the conditions set by the convention concluded on March 4, 1935, between the colony of Belgian Congo and Mr. Max Lohest and approved by decree of June 28, 1935; the rights and obligations resulting from this convention having been transferred by Mr. Max Lohest to the Compagnie du Kivu with the authorization of the Minister of Colonies dated July 29, 1935. However, in the case of exploitation of diamond or precious stone mines, the colony had the right to demand that a special company be set up.

- Subject to authorization by the Minister for the Colonies, the research, study and exploitation of all other deposits located in the Belgian Congo in the areas managed by the colony, either for itself or on behalf of third parties, either by itself or through third parties, individuals or companies, either jointly or in participation or in any other form.

- The mechanical and metallurgical treatment of mineral substances to be derived from the said deposits.

- The sale of these substances, both in their raw state and after treatment, and, in general, all operations incidental to the first, second and third above.

- To study and possibly construct and exploit all land, river and sea communication routes; to organize, in any case, all transport operations or undertakings, provided that they serve solely to facilitate its supplies and the disposal of its products; to carry out, for the same purpose, all operations relating to the use of any mechanical or electrical force which it may have at its disposal.

- With the authorization of the colony, to take an interest by way of contribution, merger, subscription, participation, financial intervention or otherwise in any mining company, existing or to be created, working in Belgian Congo or Ruanda-Urundi, whose object, either directly or indirectly, would be similar, analogous or related to its own, and whose assistance would be useful to give it any advantage whatsoever from the point of view of the realization of its corporate object or the sale of its products.

- With the same authorization, to carry out any commercial, civil, industrial, land, agricultural, mining, or financial operations likely to further its purpose.

- Constitute, with the authorization of the colony, subsidiaries for the purpose of researching and exploiting mines in the Belgian Congo and in Ruanda-Urundi and take interests in mining companies working in the Belgian Congo and in Ruanda-Urundi (12-(27-28/03/1939)-3311).

Changes in capital

On February 17, 1941, the capital was increased from 1,500,000 francs to 3 million francs by the creation and issue at par of 3,000 new Series A shares subscribed and fully paid up. In addition, 3,000 Series B shares were created which were remitted to the Government of the Colony (21-(1953 T4) -3459/60).

On April 8, 1948, the capital was again increased by 7 million francs to 10 million francs through the creation and issue at par of 14,000 new Series A shares subscribed and fully paid up. In addition, 14,000 Series B shares were created and delivered to the Government of the Colony (21-(1953 T4) -3459/60).

Event(s), participation(s), dividend(s)

Report of the Compagnie du Kivu of 1940-45, this case did not seem to meet the expectations of its leaders who tried to provoke its start (21-(1948 T6) -2743 to 45). The Société Minière de la Tele carried out research and exploitation work on behalf of the Company.

1947 - Report of the Compagnie du Kivu of 1948. It was mentioned that the Company made a profit of 639,579.79 francs which was written off on the first establishments (21-(1953 T3) -2268).

1948 - Report of the Compagnie du Kivu of 1949. An unfavorable balance of 1,548,375.20 francs was written back. In the second half of the year, efforts were focused on prospecting and the construction of camps and access roads (21-(1950 T3) -2268).

1949 - Report of the Compagnie du Kivu of 1950. For the 1949 financial year, the balance sheet mentioned that the previous losses were reduced to 812,074.17 francs. The increased production and the recovery of the tin price could lead to more satisfactory results (21-(1951 T3) -2603).

1950 - Report of the Compagnie du Kivu of 1951. Prospects remain good. The balance sheet as at December 31, 1950 leaves a profit of 987,988.15 francs after the previous loss has been cleared and allocated to depreciation. This profit made it possible to distribute an initial dividend of 30 francs net per share (21-1952 T3) -2513).

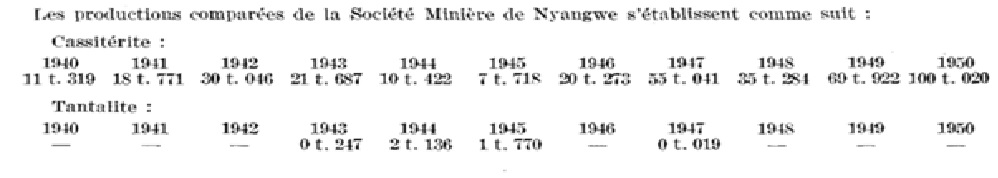

1952 - Production during the financial year was 56,670 tons of cassiterite containing an average of 71.21% tin and 3 tons of mixed tantalifère. The 1952 balance sheet showed no profit or loss (21-(1953 T4) -3460/61).

1953 - An agreement was reached with the Société Minière de la Tele to continue to undertake the technical work of the Company in Africa. The production was 62,100 tons of cassiterite containing an average of 71.67% and 5 tons of mixed tantalifère. As at December 31, 1953, 13 mining permits covering an area of 25,000 hectares were granted to the Company, of which 8 for cassiterite and 5 for mixed minerals (cassiterite and columbo tantalite). For the three mining applications covering 1,488 hectares remained pending. The 1953 financial year closed with a loss of 993,658 francs (21-(1954 T4) -3632).

1954 - Production in 1954 amounted to 87,780 tons of cassiterite containing an average of 74.5% tin. At the end of 1954, 16 mining permits covering an area of 26,497 hectares were granted to the Company, 10 for tin (covering 13,198 hectares) and 6 for tin and columbo-tantalite (covering 13,269 hectares). The Company also held 7 special exploration permits, 3 for gold and 4 for tin and mixed columbo-tantalite. The balance sheet as at 31 December 1954, after allocation of 1,308,333 francs for depreciation, left a loss increased from 993,658 to 1,794,637 francs (21-(1956 T4) -3926).

Net dividends

Exercices Act. Sie A Coupons n° | 1950 30 1 | 1951 45 2 | 1952 à 56 0 | 1957 175 3 | 1957 70 4 | 1959 47 5 |

Dissolution and liquidation

The state of the Company's affairs, the lack of prospects for developing its concessions and the size of the loss incurred led the Company's EGM to put it into early liquidation on October 1, 1956 (21-(1956 T4) -3926).

Three liquidation distributions were made: 175 francs on April 1, 1957, 70 francs on August 1, 1957 and 47 francs on March 3, 1959 (21-(1957 T1/1958 T4) -1023/4008).