EXPLOITATIONS AGRICOLES ET INDUSTRIELLES DE LA BIARO S.C.A.R.L.

Thanks to Mr. Pierre Van Bost " L'héritage des Banoko" for the photos published in this article.

Constitution

The Société Exploitations Agricoles et Industrielles de la Biaro was incorporated in Brussels on December 1, 1925 with a capital of 5 million francs represented by 10,000 shares of 500 francs. The registered office was established in Biaro (Stanleyville district), the administrative headquarters in Brussels.

Of the 10,000 shares, 1,000 fully paid-up shares were allocated to the contributor mentioned below, the remaining 9,000 shares were subscribed for by:

Compagnie du Congo pour le Commerce et l'Industrie, 3,900 shares; Mutuelle Mobilière et Immobilière, 2,000 shares; Société Forestière et Commerciale du Congo Belge, Caisse Centrale de Crédit du Boerenbond and Société de Colonisation Agricole au Mayumbe, each 1,000 shares; Baron Emile Tibbaut, 100 shares.

These 9,000 shares were 80% paid up, i.e. 3.6 million shares made available to the company.

Contribution(s)

Mr. Mertens contributed the land he owned in full ownership in Biaro (Stanleyville district), applications and promises for land concessions in Assengwe and Katende (Stanleyville district), the total area of these three estates amounting to about 1,500 hectares; plantations, crops and nurseries existing on the said lands, dwellings, a coffee processing plant and a sawmill with motive power, stores, merchandise, products and all that was his property in the above-mentioned territories.

These contributions were made under the following terms and conditions:

In remuneration of these contributions, Mr. Mertens was granted, in addition to the profits and benefits provided for in the said deeds, 1,000 fully paid-up shares of 500 francs each.

First Board of Directors

For the first time, the number of directors was set at 9 members:

Charlemagne Boulard, Alphonse Cayen, Emmanuel Janssen, Baron Henri Lambert, Maurice Lippens, Egide-Joseph-Hubert Mertens, Pierre Miny, Marcel Serruys, Baron Emile Tibbaut.

Object

Change(s) in capital, event(s), shareholding(s), dividend(s), quotation

Period before World War II

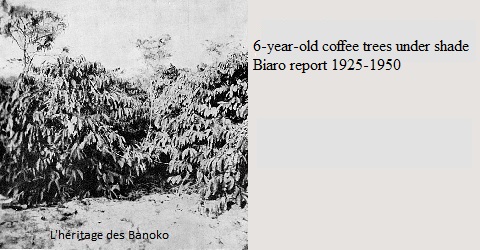

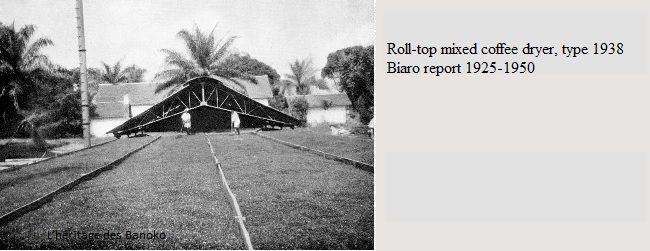

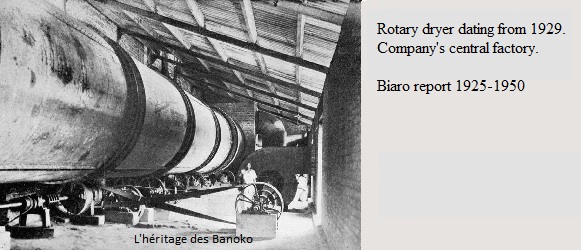

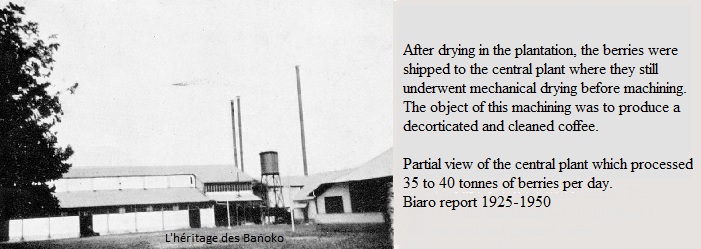

In 1926, the company harvested about 700,000 kg of coffee berries in the Biaro area, which after processing gave about 170,000 kg of green coffee. Parallel to the production, the Company continued to expand the Biaro estate, without forgetting the concessions of Katende and Assengwe, and new plantations (Oluko, Maïko and Genegene) were acquired. Biaro coffee was popular on the Antwerp market (21-(1929 T1)-664/65).

On 5 March 1928, the capital was increased to 12,500,000 francs by the creation of 15,000 shares of 500 francs each, which were entitled to half of the dividend for the 1928 financial year. These shares were subscribed at par by the Banque d'Outremer, which offered 14,000 shares for subscription, at the same price, to existing shareholders, on an irreducible basis, at the rate of 7 new shares for 5 old shares (21-(1929-T1)-664 and 65).

On July 8, 1937, the company decided to reduce the capital by 2,500,000 francs to 10 million francs by repayment of 100 francs per share. This repayment was made on October 1, 1937 (21-(1941-T3)-689).

At the end of 1938, coffee plantations covered an area of 1,892 hectares, however, in 1939, some coffee fields were exhausted, and production fell to 887 tons in 1939 from 1,401 tons in 1938.

Following the 1938 decree prohibiting the establishment of new coffee plantations, the Council took certain measures to create other resources, and by the end of 1939, the company had planted 164 hectares of palm trees and 132 hectares of grafted rubber trees in the coffee fields (21 (1941 T3)-689/90).

During this period, the company made a total gross profit of more than 25 million francs, which made it possible to distribute an average dividend of 23.90 francs for each share of 500 francs for the financial years 1926 to 1939.

The share will be traded on the Brussels Stock Exchange in 1937. The share price on December 31, 1937, 38 and 39 was respectively 752.50, 577.50 and 440 francs (21-(1941 T3)-690).

War period

At the end of 1944, the total area under cultivation (coffee, rubber, palm, and mixed plantations of these species) covered 2,056 hectares. The production of green coffee reached: 1940, 1,275 tons; 1941, 1,271 tons; 1942, 1,357 tons; 1943, 1,279 tons; 1944, 1,468 tons. The products were sold to Sudan, South Africa, and the United States in 1940 and 1941; then the coffee was sold to the Leopoldville Sales Office (21-(1946/47 T7)-2957).

The profits for this period made it possible to pay dividends for a total sum of 120 francs for each share (21-(1946/47 T7)-2958).

Post-war period

In 1946, the company bought from Mr. Deraes, a settler in Songa (Kewe), a 500-hectare freehold concession planted with 104 hectares of coffee trees and 101 hectares of rubber trees.

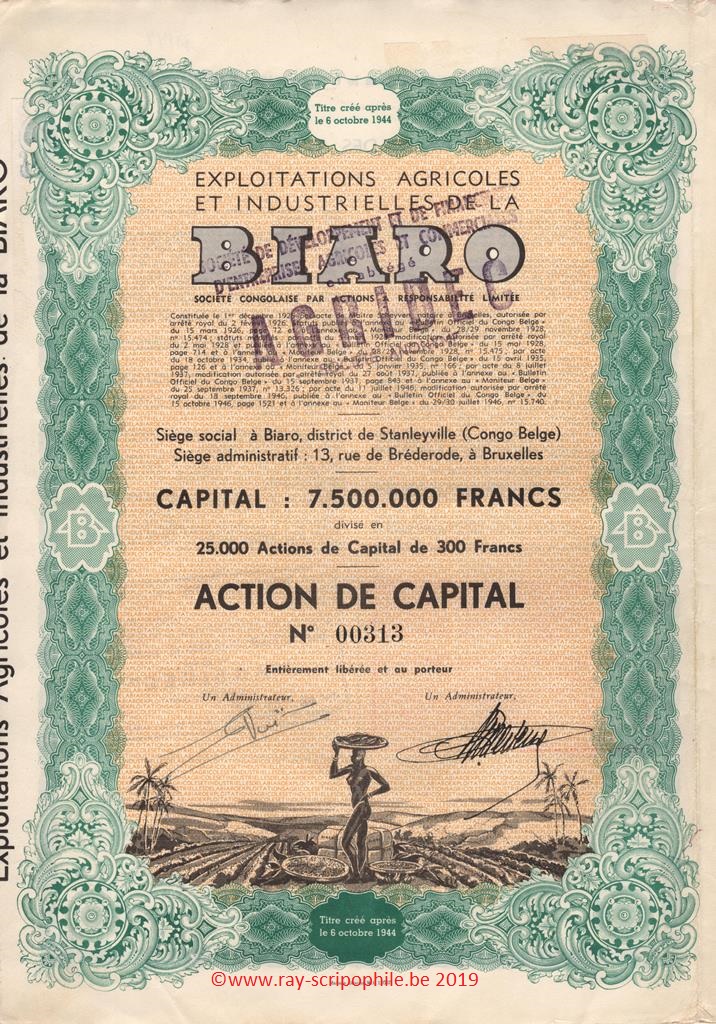

On July 11, 1946, the company decided to reduce the capital from 10 million to 7.5 million francs by redeeming 100 francs per share (21-(1946/47 T7)-2957).

At the end of 1946, the situation of the plantations was 1,457 hectares of monoculture coffee trees, 404 hectares of mixed coffee/ rubber trees, 416 hectares of monoculture rubber trees, 130 hectares of mixed coffee/palm trees and 23 hectares of pure palm trees for a total of 2,430 hectares.

In the same year, the company created several hectares of new coffee plantations to replace a corresponding number of old plantations that had been exhausted (21-(1946/47 T7)-2958).

As a result of the adverse effects of the ban on the establishment of new coffee plantations from 1938 to 1944, the area of monoculture coffee plantations at the end of 1947 only covered 1,290 hectares, a decrease of almost 40% compared to 1938. These hectares of difference were partly used for rubber and palm crops. Coffee production in fiscal year 1947 was disappointing, reaching only 684 tons compared to 1136 tons in the previous year. For other crops, rubber production was 16,682 kg and palm oil production was 36,171 liters (21-(1949 T6)-2388).

In 1950, the total area of plantations was 3,211.5 hectares. Coffee production was 911,410 kg, rubber production was 34,671 kg (21-(1951 T3)-2450).

In 1951, the company proceeded to the exchange, title for title, of its old capital shares of 300 francs for new shares with coupons 23 and following attached (21-(1951 T3)-2449).

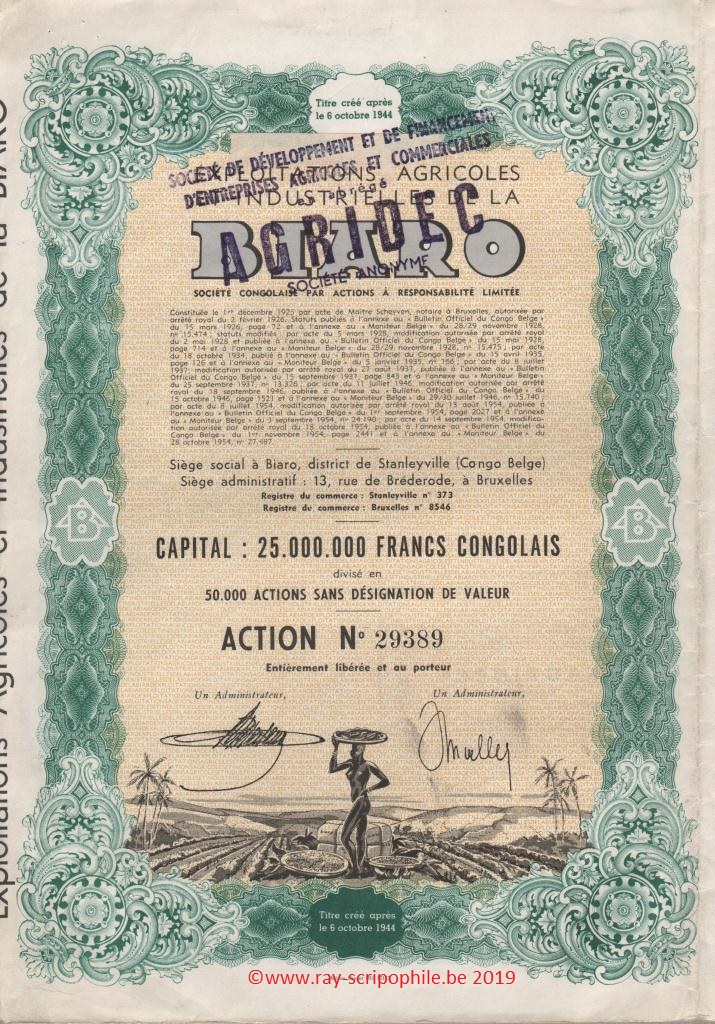

On September 14, 1954, the Extraordinary General Meeting of Shareholders decided to remove the reference to the par value of the shares and to express the capital in Congolese francs. The same meeting decided to increase the share capital by 17.5 million Congolese francs to 25 million Congolese francs by incorporation of reserves. As a result of this increase, 25,000 new shares were created with dividend rights as of January 1, 1954, which were allotted on a share-for-share basis to the holders of the old shares (21-(1955 T3)-2445).

In 1960, the fall of more than 30% in coffee prices and the increase in operating costs due mainly to the sharp rise in wage costs of the Congolese workforce the company was forced to reduce the surface area of coffee trees, it kept only 750 hectares in relation and production was 886 tons, the surface area of rubber trees was 1,000 hectares and its production produced 625 tons against 761 tons in 1959. The decrease in production was due to the disturbances that occurred in July-August 1960. At the end of 1960, the company still had four Europeans in service and 900 Congolese workers of all categories (21-(1961 T4)-3555).

On June 30, 1960, by the effect of the law of June 17, 1960, the company was governed by the Belgian laws on commercial companies, the capital was expressed in Belgian francs (21-(1961 T4)-3553).

In its meeting of June 20, 1960, the Board of Directors decided, within the framework of the law of June 17, 1960, to contribute to one or more companies of Congolese rights, existing or to be created, branches of activities of the company on the territory of Congo, and the assets necessary for the exercise of these activities, including concessions, permits and rights of any kind which it held in Congo.

In execution of this decision, the S.A.R.L. Exploitations Agricoles et Industrielles du Biaro, abbreviated to "La Biaro", was incorporated on December 27, 1961 with a capital of 100 million Congolese francs represented by 100,006 shares sdv.

Following the contributions, the Belgian company was allocated 100,000 shares in the new Company (21-(1963 T3)-2820).

During the post-war period, the company performed remarkably well, which made it possible to distribute a dividend every year until 1958:

Exercices | 1945 | 1946 | 1947 | 1948 | 1949 | 1950 | 1951 | 1952 | 1953 | 1954 | 1955 |

Div. net in BEF *After allocation | 24 | 22,75 | 0 | 36 | 83 | 166 | 249 | 249 | 280 | 150* | 150 |

Exercices | 1956 | 1957 | 1958 | 1959 | 1960 | ||||||

Div. net in BEF | 75 | 75 | 75 | 0 | 0 |

The share prices on December 31 also reflected these good results:

Shares prices on 31/12 | 1945 | 1946 | 1947 | 1948 | 1949 | 1950 | 1951 | 1952 | 1953 | 1954 | 1955 |

In BEF | 2.020 | 1.575 | 900 | 615 | 1.400 | 2.880 | 3.650 | 3.340 | 3.910 | 6.000* Before allocation | 2.790 After allocation |

Extreme prices | 1956 | 1957 | 1958 | 1959 | 1960 | ||||||

Max. in BEF | 2.920 | 2.760 | 1.729 | 1.250 | 770 | ||||||

Min. in BEF | 2.340 | 1.385 | 1.135 | 668 | 200 |

After 1960

In 1962, following the sale of all its activities in the Congo to the Congolese company La Biaro, the Belgian company was renamed Société de Développement et de Financement d'Entreprises Agricoles et Commerciales, abbreviated to "Agridec"; its corporate object was modified as follows:

Its main corporate object was:

Both in Belgium and abroad, the management of agricultural enterprises and all operations related to agriculture and the industry of agricultural products and derivatives.

All studies and services of a technical, commercial, administrative, or other nature, likely to promote the development of all agricultural enterprises or dealing with their products.

Trade in all its forms, in products from agricultural enterprises and in goods intended for them, the acquisition of holdings in all agricultural, industrial, and commercial businesses (21-(1963 T3)-2819 and 2821).

Agridec provided its Congolese subsidiary with all the technical assistance it needed on the administrative, technical, and commercial levels until the measures decreed on November 30, 1973 by the Zairian Head of State (zaïrianisation), All the goods were taken over by the State which placed them at the disposal of the Office du Caoutchouc Naturel on January 11, 1974 (21-(1974 T3)-1858).

Subsequently, Agridec changed its orientation and became a portfolio company to later become a real estate and movable investment company, and several changes of capital and exchanges of securities were made.

Take-over bid

On April 27, 2007, FIBP, a subsidiary of Fortis Assurance Belgium, launched a takeover bid at a price of 204 euros for all Agridec shares, a takeover bid was closed on May 30, 2007; the Agridec share was delisted from the Brussels Stock Exchange (Echo de la Bourse of May 5, 2007).