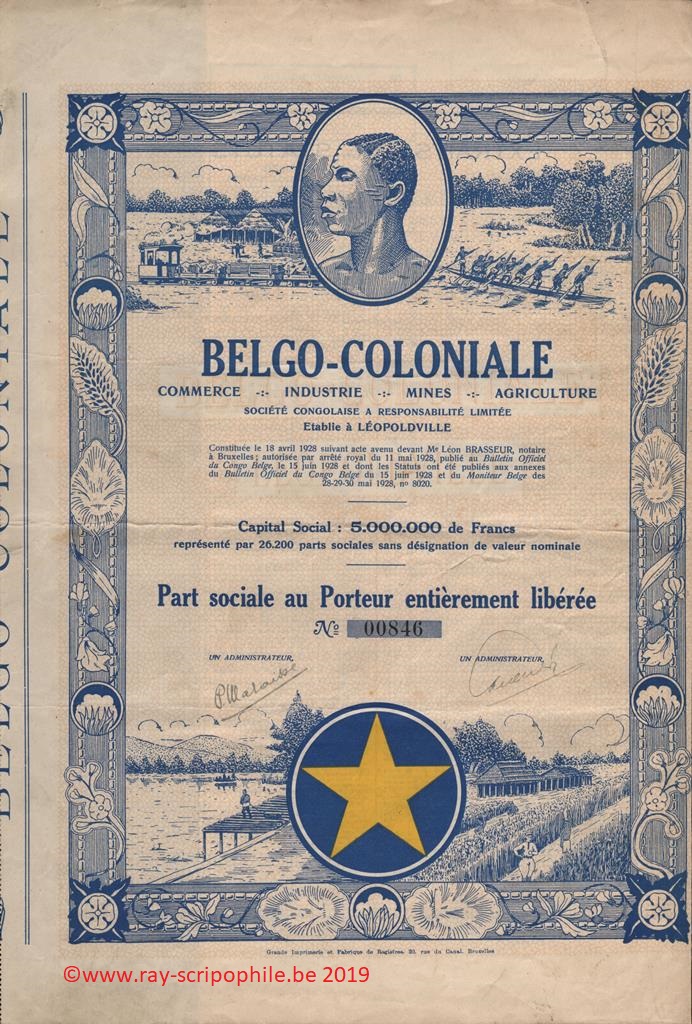

BELGO-COLONIALE Commerce - Industrie - Mines - Agriculture S.C.A.R.L.

Constitution

The Belgo-Coloniale was founded on April 18, 1928 with a capital of 5 million represented by 26,200 sdv shares. The registered office was established in Léopoldville, the administrative headquarters in Brussels.

Of the 26,200 shares, 7,200 were allocated to the holders of shares in the capital of the Belgian Anonimous Society La Belgo-Coloniale in liquidation following the contribution of all the liabilities and assets of the said company.

The remaining 19,000 shares were subscribed for in cash and paid up at a rate of 57.16 francs per share by the comparators:

Messrs. Henri Ferauge, 150 shares; Joseph Capellen, 150 shares; Jean Comte de Meeus, 150 shares; Raymond Berger, 150 shares; Auguste Ardies, 150 shares; Franz Leva, 150 shares; Charles Hossey, 50 shares; Emile Joseph Dupont, 50 shares; Joseph Rousseaux, 50 shares; Charles Hossey, 50 shares; Emile Joseph Dupont, 50 shares; Joseph Rousseaux, 50 shares; Joseph Stilmant, 50 shares; Pol Malaisse, both for himself and for a group, 2,900 shares and Banque de Charleroi S.A., both for itself and for a group, 15,000 shares.

Contribution(s)

The Company in liquidation La Belgo-Coloniale contributed:

A property located in Léopoldville, touching to the north on the Avenue de la Cité, to the south on a public road, to the east at the Roundabout and to the west at the Colony, and comprising a parcel of land of fourteen Ares forty-three hundredths twenty-two hundredths, as well as the buildings erected on it and consisting of dwelling houses and shops;

All the rights the company has to a series of trading posts located in various centers of the Lake Léopold II district, including buildings made of hard and indigenous materials, particularly in Inongo, Kiri, Lokolama, Lukanga, Bokoluwange, Ireka, Mushiè;

A steam tug, called Le Nervien, with its barges, boats and all the operating equipment of this flotilla;

Rolling stock, consisting of two motor trucks, all the tools and furniture contained in the above buildings and trading posts;

The interest it holds in the limited partnership, Constructions Métalliques et Navales Raymond Berger et C', a limited partnership, whose head office is in Gilly (Belgium) and whose operating headquarters are in Kimpoko (Belgian Congo);

Of all the goods generally of any kind found in the Company's various counters.

First Board of Directors

For the first time, the number of directors was set at eight; Messrs. Henri Ferauge, Raymond Berger, Jean Comte de Meeus, Pol Malaisse, Joseph Capellen, Marc Comré, Franz Leva and Auguste Ardies

Object

The purpose of this Company was to harvest, exploit, trade, raise livestock, cultivate all products in the Congo Basin, in other parts of Africa and in all European and overseas countries, and to carry out all commercial, industrial, agricultural, mining or transport operations, imports and exports of all kinds.

It could acquire, sell, give or lease all movable or immovable rights, all concessions and patents necessary or useful for the realization of its object, all commercial, industrial, financial and agricultural establishments.

In a word, it could carry out all operations that are directly or indirectly related to the company's purpose or that are likely to promote, improve or extend one or other branch of the company's activity.

It could carry out its object 1° directly and by itself, or 2° indirectly by means of contributions, transfers, shareholdings, financial intervention, mergers, purchases of shares, bonds, interest shares and in any other manner (12-(28-29-30/05/1928)8020).

Changes and transformations of capital, amendments to the articles of Company

On October 23, 1928, the Company increased its capital by 2.5 million francs to 7.5 million francs through the creation of 16,666 new shares which were distributed as follows:

8,000 fully paid-up shares were allocated to the firm Menteau et Maes, a general partnership, in liquidation, in order to remunerate it partially for the contributions (plantations and forestry and agricultural concessions), dwellings, sheds, stores and equipment.

8,666 shares subscribed by the limited partnership Ardies, Mangon & Cie in Brussels for themselves and a group, the capital of 1.3 million francs was fully paid up and a share premium of 129,900 francs was paid to the benefit of the company. Ardies, Mangon & Cie undertook to offer or to have offered, within a period of 6 months, by public subscription, to the holders of old shares, as an irreducible entitlement, new shares in the proportion of one new share for 6 old shares at a maximum price of 175 francs per new share (12-(13/12/1929)18545).

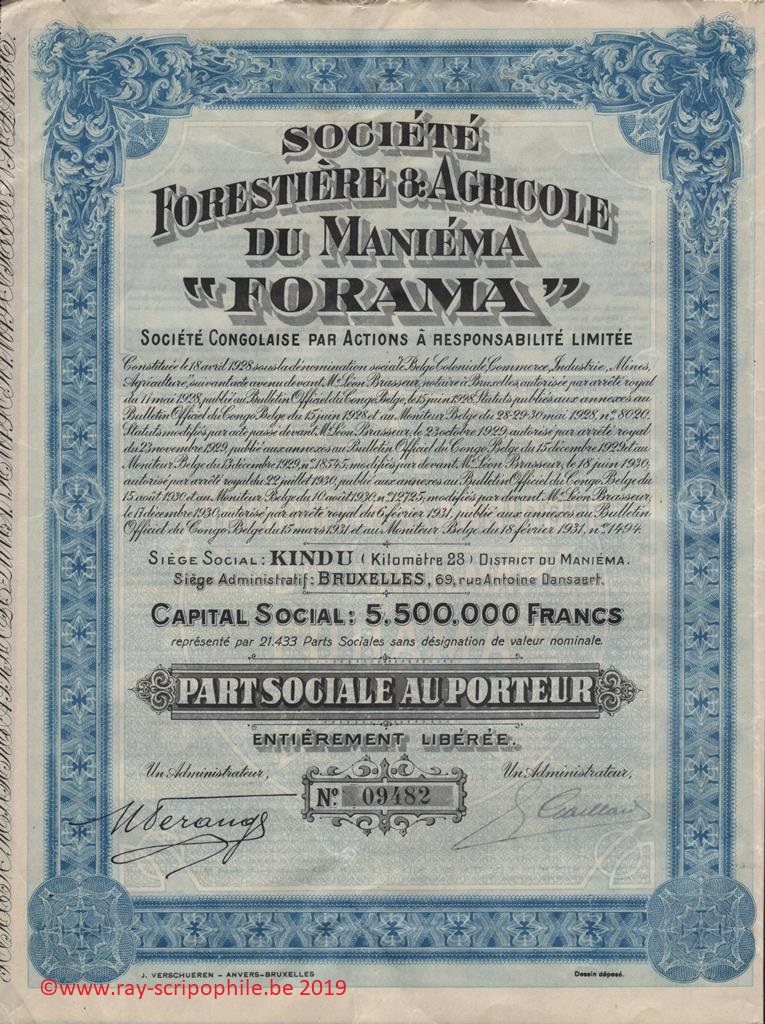

On December 17, 1930 the Company decided to remedy the situation by reducing the capital to 5.5 million francs, the number of shares was also reduced to 21,433 shares. The capital was represented by the exchange of two old shares for one new svn share. The company took the name of Société Forestière Agricole du Maniéma "FORAMA", the head office was established in Kindu (km 28), district of Maniéma and the administrative headquarters in Brussels (12-(18/02/1931)-1494).

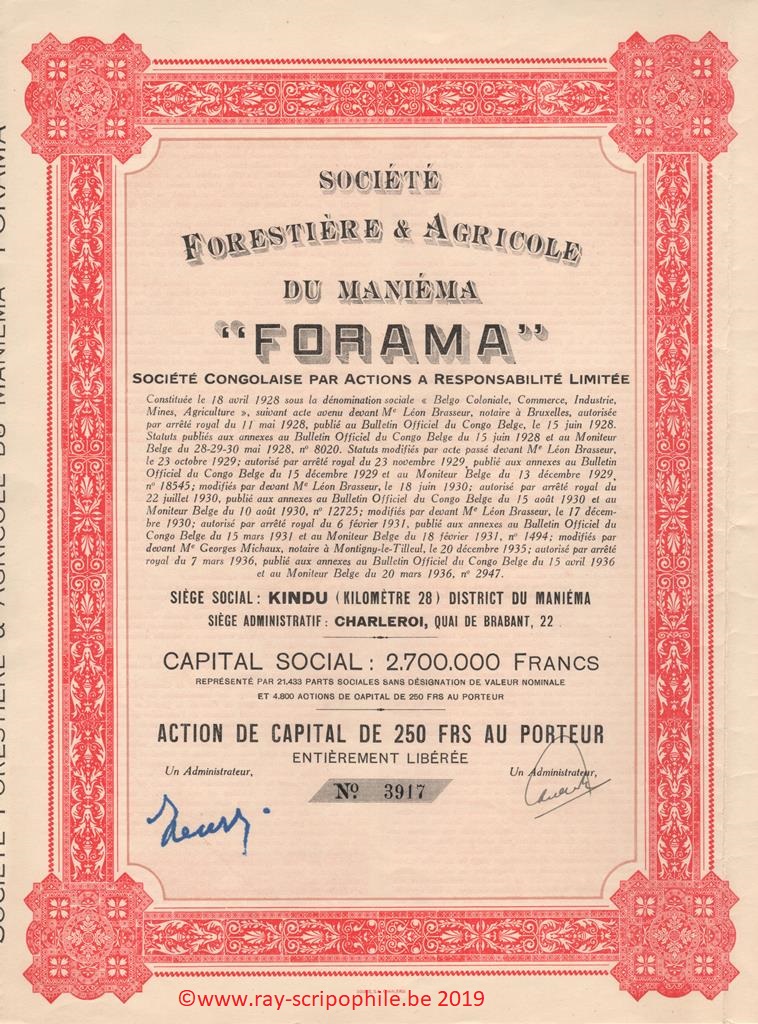

The General Meeting of December 20, 1935, following the situation of the Company, decided not to dissolve the said Company, but to reduce the capital by 4 million francs without changing the number of shares. On the same day, the capital was increased by BEF 1.250 million by the creation of 4,800 shares with a capital of BEF 250 which were subscribed by the S.A. Financière, Industrielle et Coloniale having its registered office in Charleroi, the capital was paid up in full. The latter undertook to offer or have offered, by public subscription, to holders of existing shares, the capital shares at a maximum price of BEF 265 per new share (12-(20/03/1936)-2947).

In 1948, despite the loss of more than half of the capital, the AGM of September 16 decided, as in 1935, not to dissolve the Company but to reduce the capital by BEF 1.5 million to BEF 1.2 million in order to clear the loss, up to a maximum of BEF 1.412 million, and to allocate the surplus to a tax provision.

At the same meeting, the capital shares were unified by exchanging the capital shares for shares at a ratio of five shares for one share, and the capital shares were stamped to represent shares with five shares.

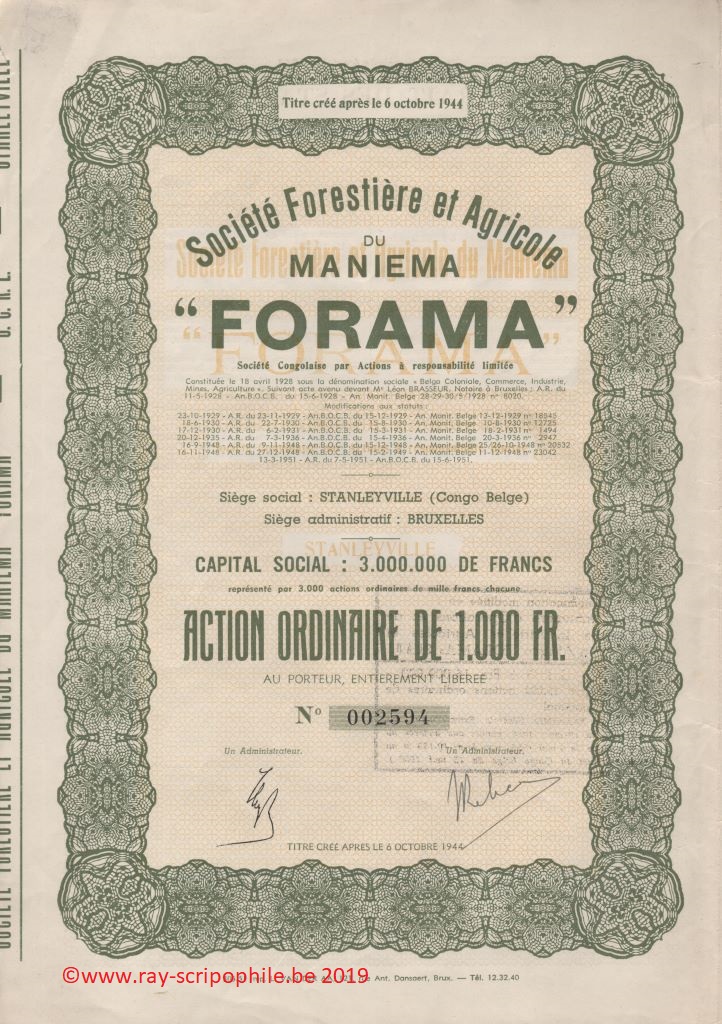

The capital of 1.2 million was then represented by 47,705 sdvn shares. On the same day, the registered office was transferred to Elisabethville and the administrative office to Brussels (12-(25-26/10/1948)-20532).

The same year, on November 16, the AGM increased the capital to BEF 3 million by creating and issuing 71,550 new shares at a price of BEF 25.75 per share, identical to the old ones.

The said shares were subscribed by Coloniale de Belgique S.A., which undertook to offer at the price of 26.50 francs to the old shareholders, at the rate of 30 new shares for 20 old unified shares, the balance not subscribed as an irreducible right could be subscribed as a reducible right. The capital of 3 million was then represented by 119,255 sdvn shares (12-(11/12/1948)-23042).

On March 13, 1951, a new representation of the capital took place; to enable this new representation to take place, 17 new shares were subscribed, which brought the number of shares to 117,000 shares, which were exchanged at the rate of 1 new share for 39 old shares. The capital of 3 million Congolese francs was then represented by 3,000 ordinary shares of 1,000 francs.

On October 15, 1953, the capital was increased to 6 million francs by the creation of 3,000 shares of 1,000 francs, the latter to be subscribed in cash by Auxiliaire Minière Coloniale S.A. (2,050 shares) and Mr. J Capellen (950 shares) acting for themselves and for third parties (12-(23-24/11/1953)25723-25724).

The General Meeting of March 19, 1956 increased the capital by BEF 1.5 million by capitalization from reserves and profits as of December 31, 1955. As a result of this increase, 1,500 ordinary shares were created with the same advantages as the old shares; these new shares will be allocated to shareholders in the ratio of 1 new share for 4 held.

On the same day, another capital increase for cash was decided, the capital was increased to 15 million by the creation of 7,500 new shares with the same dividend rights as the old shares, which will be subscribed for at a price of BEF 1,075 by the Banque de Paris et des Pays-Bas, which will offer them for subscription to existing shareholders at a price of BEF 1,075 on an irreducible basis in the proportions of 1 new share for 1 old share and on a reducible basis any new shares that may become available after the exercise of the irreducible subscription right.

The same meeting decided to change the company's name to Société Financière d'Opérations et de Recherches Industrielles, Agricole et Minières en Afrique "FORAMA", transferred its registered office to Leopoldville and added the following items to the initial purpose:

- The financing, study and development of financial, commercial, industrial, mining, forestry and land enterprises, both in Belgium and in the Belgian Congo and abroad, as well as the acquisition of interests in all companies and enterprises.

- To take an interest in such companies or in companies formed to exploit them, either by seeking such companies or concessions of any kind, whether mining, agricultural, forestry, transport or other, or by directly exploiting such companies or concessions, or by participating in the foundation of special companies, intended to implement them by way of contribution, transfer, subscription of shares or bonds, or any other financial intervention process, or by forming such special companies.

- To oversee the financial service of the companies it sponsors (12-(06/05/1956)-10183).

In the same year, on November 15, the General Meeting decided to increase the share capital by BEF 15 million, from BEF 15 million to BEF 30 million, by creating and issuing for cash 15,000 new ordinary shares, participating in any profits as from October 1, 1956, pro rata temporize and for the surplus, with the same rights and benefits as the 15,000 ordinary shares currently in existence.

The limited company Banque de Paris et des Pays-Bas shall subscribe for the 15,000 new ordinary shares at a price of BEF 1,045 each, it being incumbent upon it to offer them for public subscription within a period to be determined by the Board of Directors, at the same price of BEF 1. 045 one, plus BEF 30 per share for expenses, in preference to the Company's existing shareholders, who shall have the right to subscribe, on an irreducible basis, in the proportion of one new ordinary share for one old ordinary share and on a reducible basis, for any new ordinary shares that may become available after the exercise of the right to subscribe on an irreducible basis, the whole without delivery of fractions. Forama capital was then BEF 30 million represented by 30,000 ordinary shares of BEF 1,000 (12-(12/22/1956)-30228).

The General Meeting of April 6, 1959 decided to increase the share capital by 45 million francs, bringing it from 30 million francs to 75 million francs, by creating 45,000 new ordinary shares with a par value of 1,000 francs each, of the same type and with the same rights and benefits as the 30,000 existing ordinary shares and which will be entitled, for the 1959 financial year, to three quarters of any dividend distributed to existing shares.

The said new shares shall be offered for public subscription at a price of one thousand francs:

As an irreducible entitlement: in the proportion of three new ordinary shares for two existing shares.

On a reducible basis: the new ordinary shares which would not have been subscribed irreducibly.

The same meeting decides on a second capital increase of up to 25 million francs, to increase it from 75 million francs to 100 million francs, by the creation of 25,000 new ordinary shares, with a par value of one thousand francs, of the same type and enjoying the same rights and benefits as the 45,000 ordinary shares created by the above resolution, to be subscribed at par and to be paid up on subscription by a contribution in kind.

S.A. "Compagnie Financière Internationale pour le Commerce et l'Agriculture "Fininter", having its registered office in Brussels, has declared that it is subscribing for the 25,000 ordinary shares created at the rate of BEF 1,000 per share.

In order to pay up this subscription, Fininter has declared that it has contributed to this company:

a) 8,500 shares of the S.C.A.R.L. Compagnie Congolaise de l'Hévéa, having its registered office in Boende.

b) 7,000 shares of the S.C.A.R.L. Cultures Equatoriales, having its registered office in Boende.

As a result of this contribution, evaluated globally at 25 million francs, the members of the bureau and the assembly acknowledged that the capital increase was carried out and that the 25,000 subscribed shares are fully paid up. The capital was then 100 million and was represented by 100,000 shares (12-(14/04/1959)-7535).

In 1960, on June 27, the Board of Directors, in application and under the conditions provided for by the law of June 17, 1960, decided to maintain the company under Belgian law and that the capital is expressed in Belgian francs, took the status of a Belgian public limited company; its registered office was then established in Brussels (12-(11/07/1960)-22310).

Investment(s), stock quote, dividend(s)

The first years were rather laborious, with losses on several occasions, reaching more than half of the capital in 1935 and 1948 (capital reduced to 1.2 million (12-(25-26/10/1948)-20532). It took stakes in various companies, made various changes and representations of its share capital.

It is only from 1949 that the company saw the end of the tunnel with positive results, a first dividend of 50 francs was paid to the shares of 1,000 francs, they were regular until the fiscal year of 1958 (2-1958).

Interested holding company, indirectly through S.A. Financière Lacourt, in various companies in Belgium and abroad and directly in companies operating in Congo and Venezuela. At the end of 1960, the book value of Forama portfolio was estimated at 108 million (2-1961).

For the years 1959 to 1968, following losses and write-downs of the portfolio (85.5 million 31/12/1965) (2-1966), no dividend was paid for these years (2-1960 to 1969). It was not until 1969-1971 that a dividend was paid each year (2-1973).

The Forama company was listed on the Brussels stock exchange until 1972 at a monthly public sale price of 1,000 francs per ordinary share; min, 175 BEF (2-1960) - max, 1,275 BEF (2-1956). The extreme prices in 1972 before the merger; Forama, min, 420 BEF - max, 425 BEF; Cobepa, min, 654 BEF - max, 1,270 BEF (2-1973).

Merger, dissolution, close of liquidation

On December 11, 1972, Forama merged with Compagnie Belge de Participation Paribas "Cobepa". Following this absorption, the Company was dissolved and put into liquidation. In consideration for this contribution, Forama shareholders received 7 shares of Cobepa cp 4 attached for 5 shares of Forama cp 19 attached (12(30/12/1972)-3464). The liquidation was closed on December 27, 1974 (12(17/01/1975)-214-9).