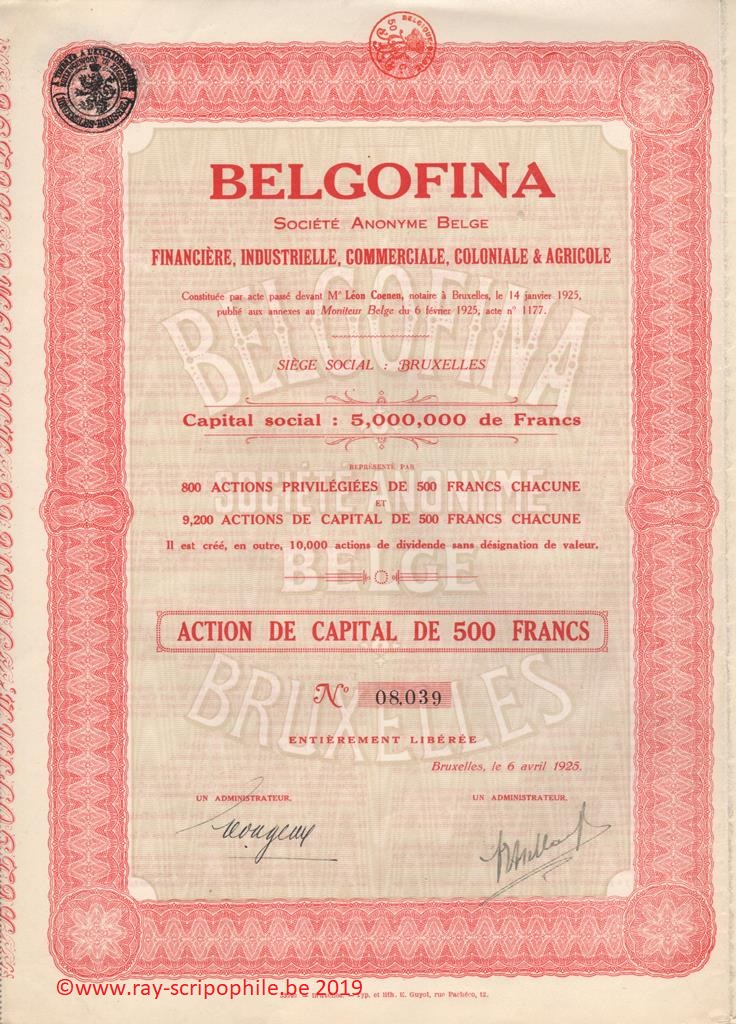

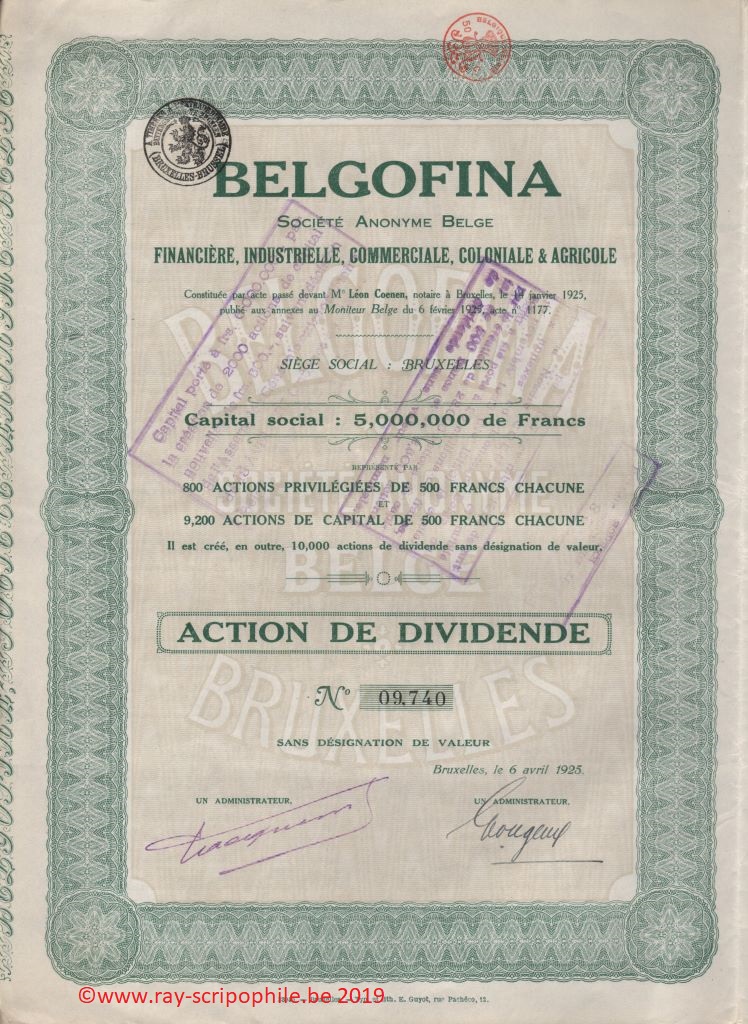

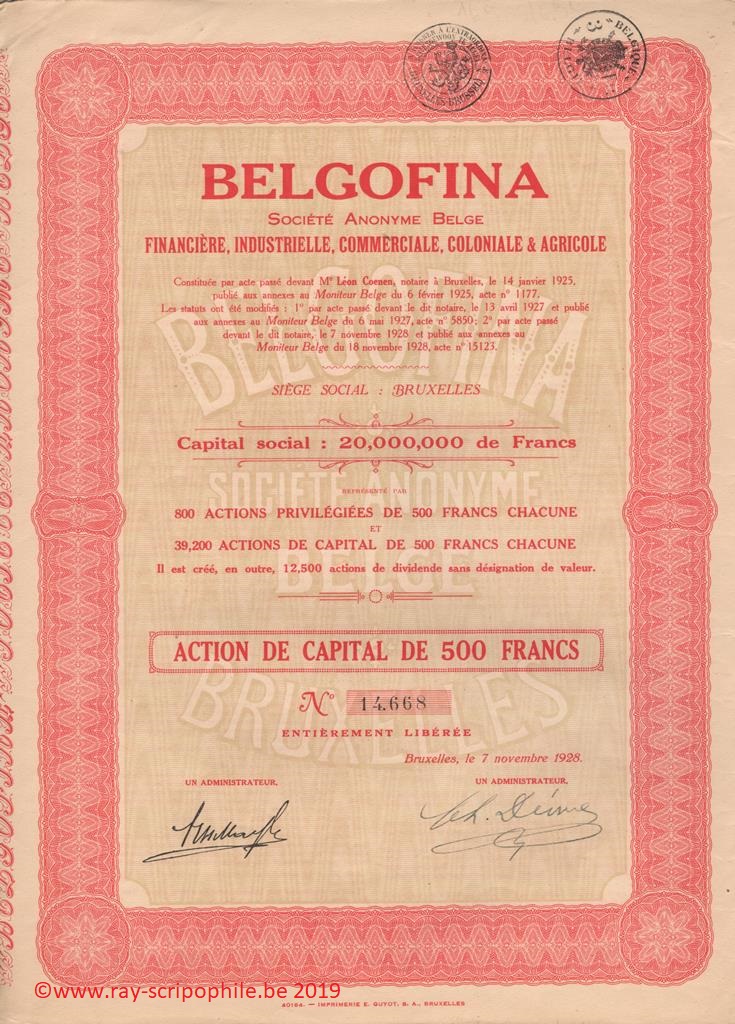

BELGOFINA - Société Anonyme Belge Financière, Industrielle, Commerciale, Coloniale & Agricole

Constitution

La Belgofina " Société Anonyme Belge, Financière, Industrielle, Commerciale, Coloniale et Agricole " was created on January 14, 1925; the head office was established in Brussels.

The capital of 5 million francs was represented by 800 preferred shares of 500 francs and 9,200 shares of capital of 500 francs. In addition, 10,000 dividend shares without designation of value were created.

Hollando-Belge, S.A. in liquidation received 9,148 fully paid-up shares of capital of 500 francs and 4,574 dividend shares for its contribution described below.

The remaining 52 capital shares were subscribed by Compagnie Générale d'Exploitations aux Indes Orientales in The Hague.

The 800 preference shares of 500 francs were subscribed by the comparators:

Compagnie Générale d'Exploitations aux Indes Orientales à la Haye, 60 shares; Arthur Hayen, 60 shares; Arthur Jadoul, 60 shares; Georges Ugeux, 120 shares; Count Edouard de Meeus, 60 shares; Adolphe Ferminne, 60 shares; Alphonse Ferminne, 60 shares; Paul Jacquemin, 60 shares; Hubert Jadoul, 60 shares; Baron Henri de Moffart, for himself and a group, 90 shares; Albert Coussot, 30 shares; Emile Misson, 30 shares; Alfred Paligot, 20 shares; Jacques Claes d'Erckenteel, Charles Deome, Pierre Anssems, 10 shares each.

The preferred shares and the 52 shares of capital were paid up by 50%; i.e. a sum of 213,000 francs made available to the Company.

As for the dividend shares, they were allocated as follows:

1) To the subscribed shares, 426 dividend shares to be distributed in the proportions of one dividend share for every two shares subscribed.

2) To Hollando-Belge, 4,574 dividend shares as mentioned above.

3) To the 5,000 shares to the holders of founder's shares of Hollando-Belge to be distributed on a share-for-share basis.

Contribution(s)

Hollando-Belge, S.A. in liquidation, has declared that it is contributing all its assets and liabilities; in consideration of this contribution, 9,148 fully paid-up shares with a capital of 500 francs and 4,574 dividend shares are allocated to Hollando-Belge.

First Board of Directors

The Meeting set the number of directors at eleven and five auditors:

Object

Changes in capital

Event(s), shareholding(s), dividend(s), quotation

1925 - For the first year of its existence, because of the improvement in the rubber market and its participation in plantation business, the company had a successful year (21-(1926 T2)-158).

1926 - A significant increase in results marked the year (21-(1928 T2) -110/111).

1927 - Belgofina's activity turned towards the Belgian Congo. It took part in the creation or extension of several colonial organizations, notably Agricomin and Etablissements Bernasconi. She was admitted as a participating member of the National Committee of Kivu and participated, with the help of various personalities, in the creation of the Colonial Union of Mines (21-(1928 T2)-110/111).

Dividendes bruts

Exercices Act. priv. Act. cap. Act. div. | 1925 64,74 39,74 10,12 | 1926 98,59 50,90 19,23 | 1927 138,59 58,59 32,05 | 1928 138,55 58,59 32,03 | 1929 0 0 0 |

Cours au 31 décembre

Catégorie Act. de capital Act. de dividende | 1928 575 frs 1495 frs | 1929 500 frs 1700 frs |

Merger

On December 31, 1930, Belgofina merged by absorption with Comptoir Peemans S.A.; because of this merger, Belgofina received 4,000 capital shares and 2,000 fully paid-up founder's shares of Comptoir Peemans S.A. (21-(1931 T3)-6/7).

On 8 March 1932, by judgment of the Commercial Court, Comptoir Peemans was, upon admission, declared bankrupt (21-(1932 T2)-1731).